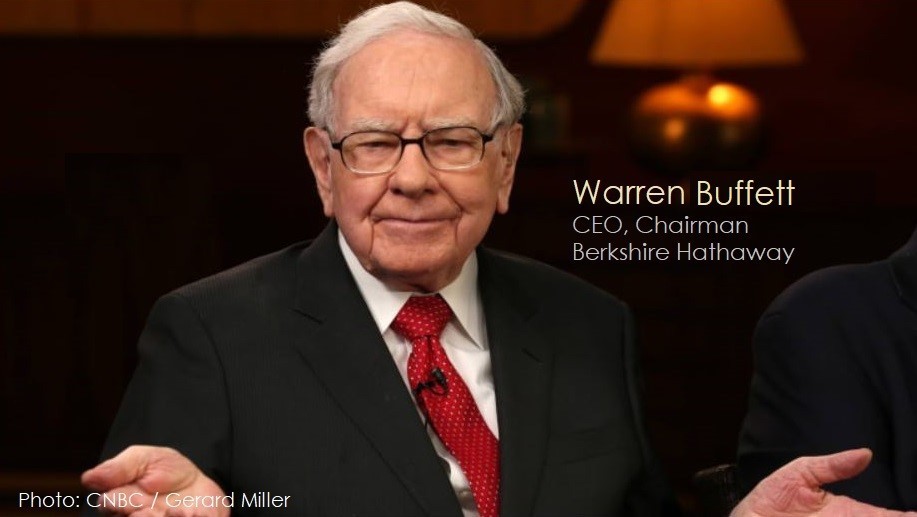

How to invest like Warren Buffett

The following article, published by TrustNet provides a simple explanation as to how Warren Buffett, arguably the best investor we have seen, has created wealth for not only himself, but the many shareholders of his conglomerate Berkshire Hathaway Inc.

Sure….. follow the steps and principals that Buffett has employed for many, many decades and create an investment portfolio along the same lines as him.

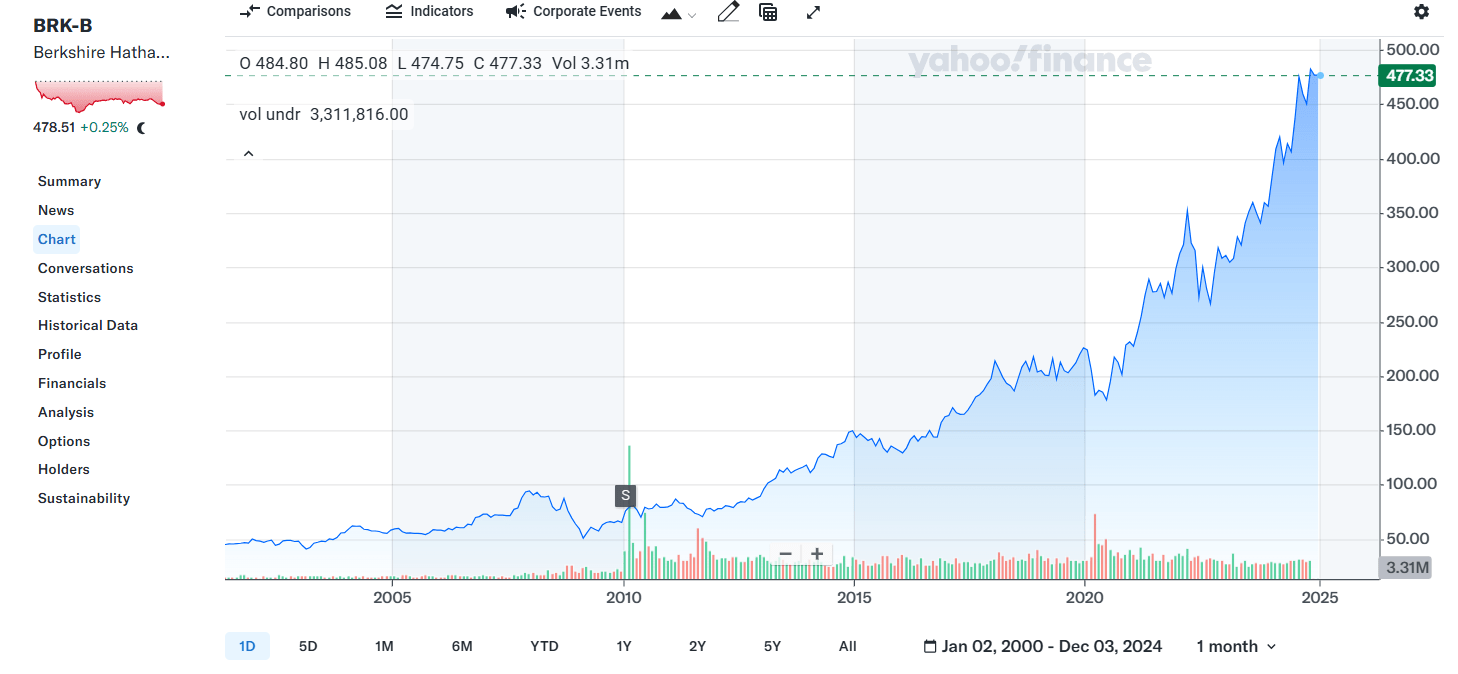

Or…… why not just invest in the listed shares of Berkshire Hathaway Inc (BRK:B) and let the following of principals and investment decisions to be done by Warren Buffett and his very experienced team.

Or…… why not just invest in the listed shares of Berkshire Hathaway Inc (BRK:B) and let the following of principals and investment decisions to be done by Warren Buffett and his very experienced team.

This stock can be held via the Ardan International Platform as well as most of the ‘open architecture’ Offshore Portfolio Bonds (such as RL360 PIMS, Utmost Executive Investment/Redemption Bonds, Investors Trust Access Portfolio, Friends Provident Reserve).

If you would like to learn more about Berkshire Hathaway Inc & how holding this stock as part of your portfolio can improve your financial situation, please press the More Information button.

25 November 2024

Warren Buffett, often referred to as the ‘Sage of Omaha’, is synonymous with success and longevity in the stock market. Buffett’s investment approach, characterised by simplicity and discipline, has not only yielded extraordinary returns for his company, Berkshire Hathaway, but also offered a model for individual investors worldwide.

FROM HUMBLE BEGINNINGS TO BILLIONAIRE INVESTOR

Buffett’s journey began in Omaha, Nebraska, where he was born in 1930. His foray into finance started early; he purchased his first stock at age 11. From running a paper route to buying a pinball machine and placing it in a local barbershop, his entrepreneurial spirit was evident. Buffett’s early life was not one of privilege but of keen interest and self-driven education in the world of finance. He honed his craft under the tutelage of Benjamin Graham at Columbia Business School, the man who would become his mentor and the father of value investing. Graham’s influence on Buffett was profound, shaping his investment philosophy fundamentally.

CORE INVESTMENT PRINCIPLES

Buffett’s investment style can be distilled into a few core principles that have consistently guided his strategy.

Value investing: Buffett invests in companies whose shares trade for less than their intrinsic values. He is known for his thorough analysis of company fundamentals and not overpaying for stocks, no matter how promising they may seem.

Long-term holding: “Our favourite holding period is forever,” he famously said. Buffett’s approach is the antithesis of the short-term trading that characterises much of today’s market movements. He believes in investing in companies that he understands and expects to continue growing and succeeding in the future.

Margin of safety: Emphasising the principle taught by Graham, Buffett always seeks a margin of safety in his investments. This means buying at a significant discount to intrinsic value to cushion against errors in judgment or unforeseen market downturns.

Circle of competence: Buffett restricts his investments to businesses he thoroughly understands, a practice that has kept him from making investments that don’t align with his expertise, regardless of popular trends.

Management quality: Buffett places significant emphasis on the quality of a company’s management. He prefers to invest in companies with honest and competent leaders.

INVESTING LESSONS FROM WARREN BUFFETT

Understanding a company’s value: Buffett suggests investors should only invest in companies they understand and which have intrinsic value — value that does not depend on external factors such as currency fluctuations or commodity prices.

The compounding advantage: Buffett showcases the power of compounding interest, often stressing the importance of holding stocks for the long term to maximise returns.

Staying within your circle: He cautions investors to invest within their ‘circle of competence’ and to resist the temptation to follow the crowd. This discipline helps avoid missteps in unfamiliar territories.

Rationality over emotion: Buffett has remained stoic through market fluctuations, emphasising the need for investors to be rational and not be driven by emotions. His investment decisions are based on facts and analysis, not on market speculation or investor sentiment.

Investment vs speculation: Buffett draws a clear line between investing and speculating. He advocates for investment based on solid research and long-term potential, not on the speculation of quick profits.

Warren Buffett’s success demonstrates the power of simple principles applied with discipline and patience. His approach demystifies the stock market, making it accessible and rational. As markets evolve, the core tenets of Buffett’s philosophy continue to influence countless investors, encouraging a thoughtful, principled approach to the art and science of investing.

This Trustnet Learn article was written with assistance from artificial intelligence (AI).

This article is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy, sell or hold any investment, or to adopt a particular investment strategy.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

Socially Responsible Investing – Ethical Business Standards