UK Tax Planning: Post-Budget Impact Assessment

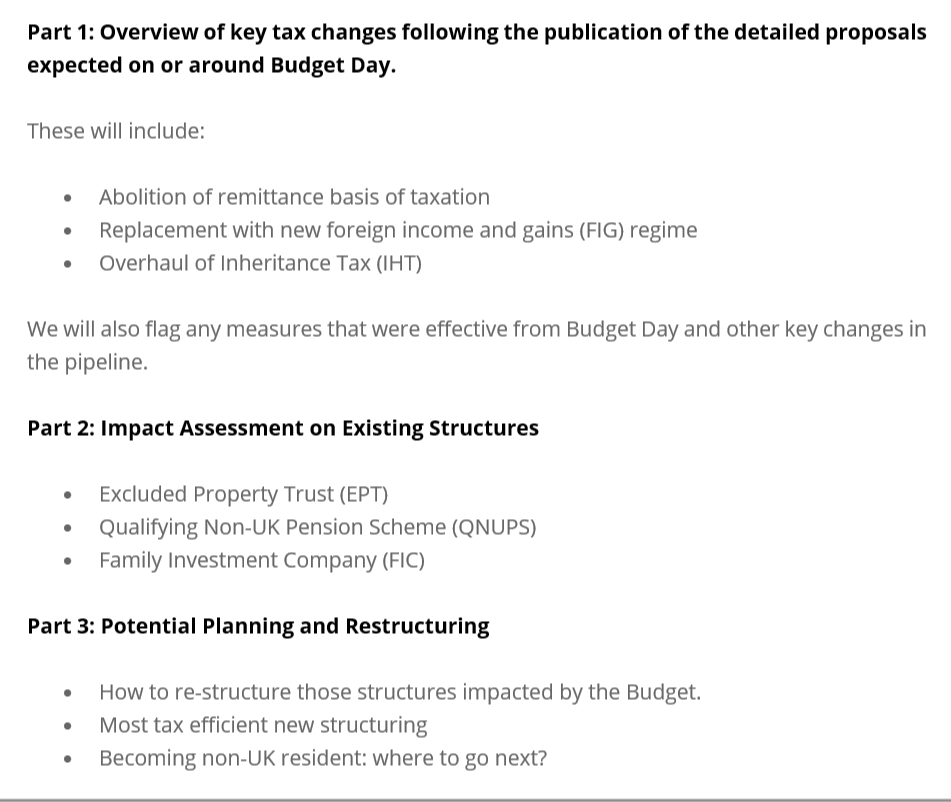

In her first Budget, UK Chancellor Rachael Reeves confirmed the abolition of the remittance basis of taxation for non-domiciled UK residents (non-doms) from 6 April 2025, as well as substantially curtailing the current protections for non-UK assets held by non-doms from UK inheritance tax (IHT)

Join Sovereign for a three part update Webinar covering the following:

To view the Webinar, please click View Video

Link to Presentation Slides can be downloaded HERE

This is a presentation from Sovereign and is for information purposes only.

Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

For further information on how the changes announced in the latest budget may affect you & your family situation, contact Stephen Strowger at OIBME Asia Ltd at stephen.strowger@oibme.com

Along with the resources and technical knowledge of Sovereign, we can then assess how these changes may affect your financial future, and provide guidance and solutions on how to minimise the negative impacts, and provide a more secure future for you and your family assets.

Socially Responsible Investing – Ethical Business Standards