How the Bank of England’s 25 basis point rate rise will affect your finances

03 August 2023

Trustnet looks at the likely implications of the BofE’s latest interest rate hike.

By Jonathon Jones,

Editor, Trustnet

The Bank of England has raised rates by 25 basis points to 5.25% at its latest meeting, the 14th consecutive increase dating back to January 2022. It is the highest rates have been since 2008 but the latest hike is a slowing from the previous increase of 0.5% last time out.

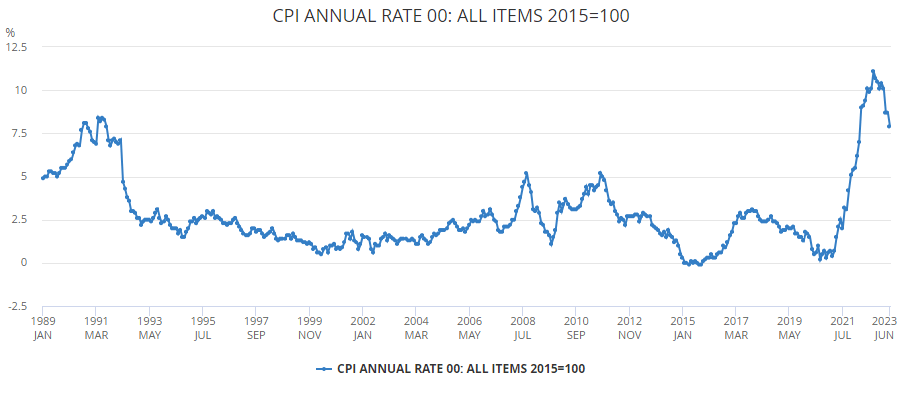

It chose to hike despite slowing inflation, which cooled to 7.9% in June, down from 8.7% the previous month, as shown in the chart below. This is still some way from the Bank’s 2% target and puts pressure on the Monetary Policy Committee to keep going.

The BofE’s decision chimes with that of the Federal Reserve last week, which upped rates by 25 basis points taking the range to 5.25%-5.50%, however most expect the US central bank to be closer to the end of its hiking cycle, with headline inflation across the pond at 3%, while core inflation stands at 4.8%.

Richard Flax, chief investment officer at Moneyfarm, said the Bank of England had chosen the “safer route” with the latest increase to tackle sticky inflation.

He noted that rate hikes are “intentionally hard on the economy, the public and businesses – to cool down activity and bring down costs”.

The other option on the table today – raising by 50 basis points –would have “inflicted shaper economic pain”, he explained.

“With the UK economy already tipping towards a recession and growth flatlining, a 50-basis point hike would have exacerbated the decline. Therefore, the BofE did not intend to destabilise the fragile economy and had to rule out the larger rate rise,” said Flax.

Consumer price index since 1989

Source: The Office for National Statistics

James McManus, chief investment officer at Nutmeg, agreed that the Bank has a difficult balancing act between hitting people’s everyday finances immediately (rising rates increase mortgage and other debt payments), while trying to stymy inflation – a more medium-to-long-term consequence.

“Unfortunately, what is good for one can be bad for the other” he said, but noted that the rise was “anticipated” by markets and lenders alike, adding that there was some reason to be cheerful on the news.

“On the positive side, the chances of a recession this year are slim – previously almost considered a certainty – and the labour market remains strong,” he said.

Below, we look at how the latest rate rises may impact people’s personal finances.

Savings

The latest hike could be good for savers, according to Rosie Hooper, chartered financial planner at Quilter, who said that it should feed through to higher yields on savings accounts.

However, some of the high street banks have been slow to pass these rate rises on to customers and the amount of interest offered is variable.

“Therefore, it’s crucial to survey the market for the highest rates as not all banks accelerate their rate increments at the same pace. Additionally, other forms of savings products such bonds, ISAs or investments should be taken into account,” she said.

Mortgages and other debt

Rachel Springall, finance expert at MoneyFacts, said the latest news will be “disappointing” to borrowers worried about rising mortgage repayments.

“Interest rates on mortgages are much higher than some may realise, so borrowers will need to ensure they have surplus funds to meet higher repayments when they come off a lower rate deal,” she said.

Springall added that fixed rate mortgages, for two, five and 10-year terms are around 3 percentage points higher on average compared to December 2021 while the average standard variable rate has risen consecutively over the same period, “so a fixed mortgage can give borrowers some peace of mind by securing their monthly repayment”.

Credit card interest may also rise, with users urged by Hooper to clear down outstanding balances as soon as possible while avoiding high-interest debt.

Pensions

The increase in interest rates could be positive news for those looing to take out an annuity, as they have a direct correlation with government bond yields.

Hooper said: “This suggests that retirees on the brink of acquiring an annuity could enjoy a superior income throughout their retirement phase. Those nearing their retirement should vigilantly track interest rates and bond yields, and seek financial advice to help plot the optimal retirement course.”

Investing

Investors looking to cash in on higher rates should consider buying bond funds, according to Rachel Winter, partner at Killik & Co, as yields are at their highest in more than a decade.

“Now could be an important time for investors wishing to take advantage of opportunities presented by this turning point. Fixed income products are one such area where the window of opportunity needs to be seized ahead of rates coming down. For savvy investors who wish to bolster their portfolios with these assets, now is the time,” she said.

The outlook for rates

Expectations are for more rate rises this year, according to Rob Morgan, chief investment analyst at Charles Stanley, although the level at which they will settle has been reduced.

“Market expectations for the peak rate have receded in recent weeks thanks to June’s inflation surprise. Having reached 6.5% on July 11th in the wake of data showing record wage growth, the latest consensus is 5.75% by the year end,” he said.

“From that point markets are pricing in rates remaining at this sort of level for a while with no significant cuts coming in the first half of 2024. Today’s announcements have not adjusted these market expectations significantly.”

Marcus Brookes, chief investment officer at Quilter Investors, also said savers should expect at least one more increase before we reach 2024, but that the rate is unlikely to reach 6% as previously predicted.

“The UK economy and consumer has been incredibly resilient but are clearly now beginning to be hit. Inflation is falling and should continue to do so for the rest of the year, even if not to that magic 2% number. The next few sets of inflation data will be crucial to see just what impact the BoE has managed to have and what is still likely to come,” he noted.

Please Note:

This article is provided for information only. The views of the author and any people quoted are their own and do not constitute financial advice. The content is not intended to be a personal recommendation to buy or sell any fund or trust, or to adopt a particular investment strategy. However, the knowledge that professional analysts have analysed a fund or trust in depth before assigning them a rating can be a valuable additional filter for anyone looking to make their own decisions. Past performance is not a reliable guide to future returns. Market and exchange-rate movements may cause the value of investments to go down as well as up. Yields will fluctuate and so income from investments is variable and not guaranteed. You may not get back the amount originally invested. Tax treatment depends of your individual circumstances and may be subject to change in the future. If you are unsure about the suitability of any investment you should seek professional advice.

Please note the above article was first published by Trust Net and should not be regarded as individual investment advice on whether to buy, sell or hold any of the funds mentioned. Please speak to Ethical Offshore Investors or your personal adviser BEFORE you make any investment decision based on the information contained within this article.

As we aim not to use commission paying funds, we will access the lowest charging version of the managed fund that is available on the relevant platform…… resulting in more of the investment growth staying in your pocket.

Speak with Ethical Offshore Investments to learn how you can save on your investment costs by investing via Ethical Offshore.

Socially Responsible Investing – Ethical Business Standards